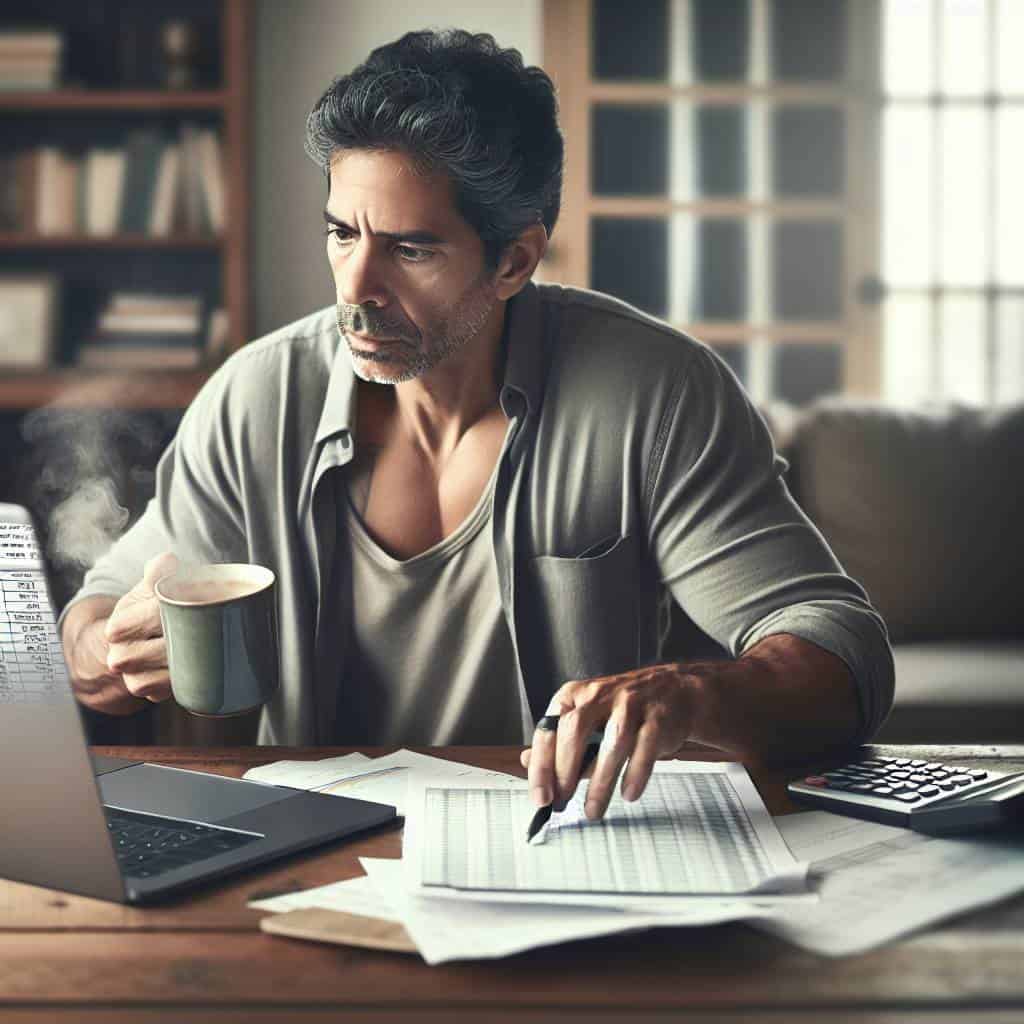

Ever find yourself staring blankly at a spreadsheet, wondering if Excel is conspiring against you? I have. Numbers have a funny way of revealing truths we’d rather keep buried. Like that time my car decided to audition for a role in a demolition derby, and I realized—not for the first time—that my so-called emergency fund was more of a theoretical concept than a financial safety net. Enter the sinking fund. It’s not a magic wand, but it’s certainly more reliable than my wishful thinking.

So, what can you expect from this deep dive into the world of sinking funds? I’ll lay it all out, no sugar-coating. We’ll tackle the nitty-gritty of planning for those inevitable big expenses—car repairs that pop up at the worst possible times, vacations that require more than just a spontaneous spirit, and other budgetary beasts. My goal is simple: to arm you with knowledge that’s both practical and realistic. The truth is, managing money isn’t glamorous, but neither is being caught off guard. Let’s face it head-on.

Table of Contents

How My Vacation Dreams Led to a Sinking Fund Epiphany

It started with a postcard. A glossy little piece of paradise featuring a beach lapped by turquoise waves, casually whispering promises of escape from spreadsheets and the never-ending cycle of nine to five. But here’s the thing—they don’t mention the price of piña coladas or the cost of that oceanfront room. That’s where my epiphany hit: if I wanted to trade in my office chair for a hammock, I needed a plan. Enter the sinking fund, my financial ally in turning dreams into reality without watching my bank account evaporate faster than sea mist.

Picture this: a sinking fund isn’t just a piggy bank with a fancy name. It’s a disciplined way to save for those big-ticket expenses—like that vacation, car repairs, or even a new roof—without the panic of a last-minute scramble. I started small, chipping away with each paycheck, earmarking a slice for my sunlit getaway. It transformed my approach to money, from dreading the unexpected to embracing the inevitable. With each deposit, the dream felt more tangible, and the fear of overspending lessened. In a world where financial storms can hit at any moment, my sinking fund became the lighthouse guiding me safely to shore.

The Brutal Truth About Financial Preparedness

A sinking fund isn’t your fairy godmother waving a wand over big expenses. It’s the cold, hard reality check that keeps you afloat when your car decides to throw a tantrum or when your dream vacation demands more than daydreams.

The Unseen Anchor in My Financial Voyage

In the murmur of ocean waves and the bustle of spreadsheets, I’ve found a certain peace with the concept of a sinking fund. It’s not glamourous, nor is it something that will win you a round of applause at the dinner table. But there’s a quiet dignity in knowing that while others might be swept away by unexpected financial squalls, I have my lifeboat ready. It’s not about being pessimistic; it’s about being prepared. In a world where car repairs and vacations don’t come with a ‘pay later’ button, this fund has become my silent partner in tackling life’s inevitable surprises.

The truth is, I’ve come to see this fund not as a limitation, but as a form of empowerment. It’s the financial equivalent of knowing how to swim before you dive into the ocean. As I stand firm on the shore of my fiscal landscape, the horizon may change, but my resolve doesn’t. The sinking fund is my testament to the fact that being an adult sometimes means planning for the things you’d rather ignore. And in this journey, it’s the unsung hero that lets me face the future with a confident nod, knowing I’ve done my part to navigate the unpredictable waters of life.