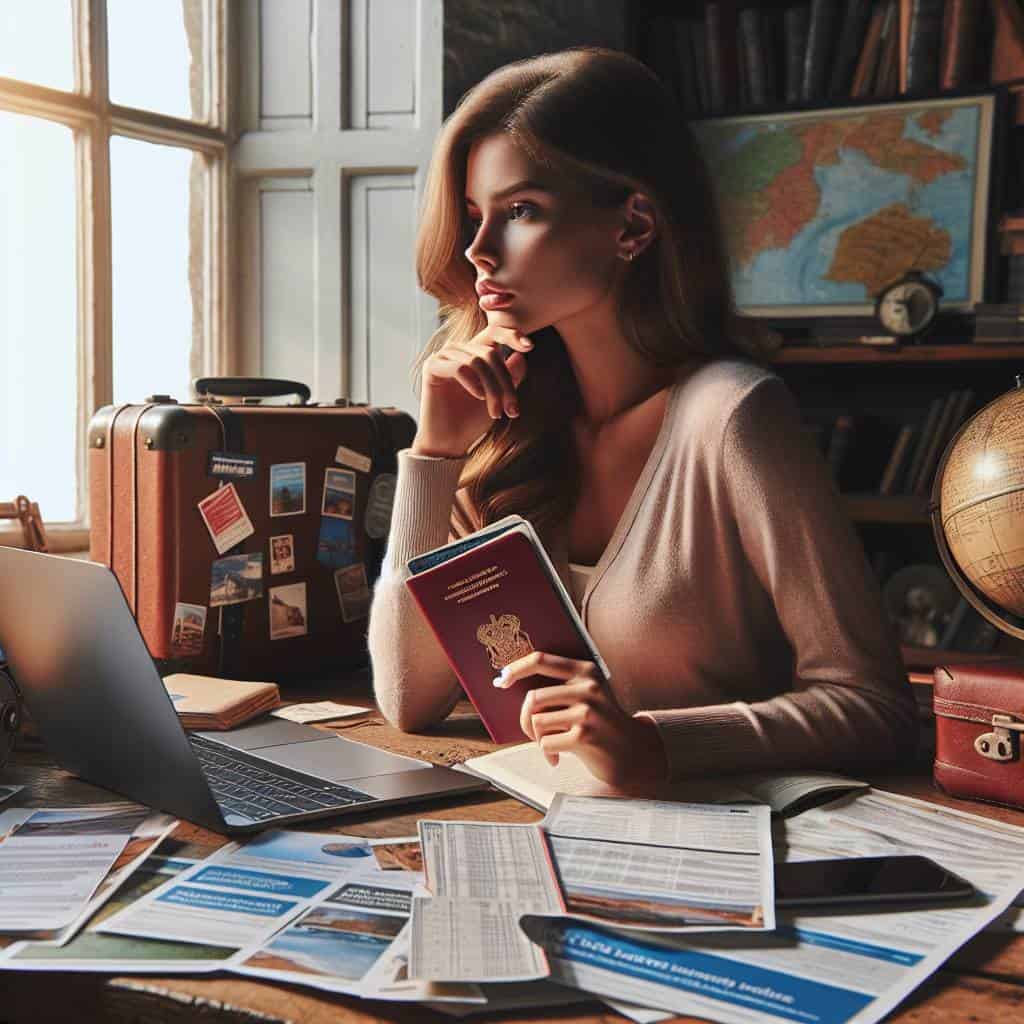

I once found myself, passport in hand, staring at a list of travel insurance options that read like a menu of doom. Each policy seemed to wager on a different flavor of catastrophe—lost luggage, missed flights, sudden illness. It’s a peculiar feeling, betting against your own luck, like a pessimist’s version of Russian roulette. But here I was, trying to pick the right disaster to prepare for. The irony? The more I read, the more I realized I had no clue what half the jargon even meant. It’s like the insurance companies speak a language designed to baffle you into submission—or at least into buying their most expensive package.

So here’s the deal, folks. I’m going to take you through this labyrinth of coverage options, stripping away the nonsense and getting to the real stuff you need to know. We’ll tackle everything from the fine print of emergency claims to the absurdity of policy comparisons. No fluff, no filler, just the raw, unvarnished truth about choosing travel insurance. Because if we’re going to gamble on our own misfortunes, we might as well know the odds.

Table of Contents

Navigating the Insurance Jungle: My Quest for the Perfect Policy

Picture this: You’re about to embark on that dream vacation—finally escaping the grind for a taste of the unknown. But first, you need to dive headlong into the insurance jungle, machete in hand, hacking away at a tangle of policies that promise the moon but might just deliver a pebble. It’s a treacherous terrain, filled with the mesmerizing calls of ‘comprehensive coverage’ and ’emergency evacuation.’ Yet, as I discovered, it’s less about the buzzwords and more about deciphering which policy is betting against your own luck—or lack thereof.

Let’s face it, choosing travel insurance is akin to selecting which minor disaster you’d like to preemptively lose sleep over. Will it be the missed flight, the unexpected hospital visit in a foreign land, or—heaven forbid—a sudden need for emergency repatriation? Each policy is a smorgasbord of potential catastrophes, wrapped up in legalese that would make a lawyer blush. And then there’s the art of comparison shopping. You’d think it would be as straightforward as comparing apples to apples, but in the insurance jungle, it’s more like apples to invisible oranges. Each policy dances around coverage types, claims processes, and exclusions with the grace of a tap-dancing bear. It’s a spectacle, really.

But here’s the kicker—after all the analysis, the spreadsheets, and the mental gymnastics, you still need to make a leap of faith. Because, in truth, no policy can guarantee absolute peace of mind. It’s about finding that sweet spot, where the coverage aligns just enough with your travel plans and risk tolerance. Will it be perfect? Probably not. But if you manage to emerge from this jungle with a policy that feels like it might actually have your back, then I’d say you’ve won the game. For now. Until the next trip, that is.

Rolling the Dice with Disaster

Choosing travel insurance is like trying to pick the least annoying emergency you’ll never face, while sifting through a labyrinth of fine print and promises they’ll never keep.

The Fine Print and the Final Word

So, here we are, at the dizzying end of my travel insurance saga. I’ve waded through enough policy details to make my head spin faster than a tourist trying to decipher a local bus schedule. And let’s be honest, the allure of emergency coverage seemed more like a siren call to the paranoid part of my brain. Yet, in this jungle of legal jargon and claims fine print, I’ve found a strange sort of peace. Maybe it’s not about predicting calamity, but rather about accepting that life is a chaotic mess, and sometimes, you just need a safety net to catch the falling pieces.

But here’s the kicker. After all the comparisons and the endless ‘what if’ scenarios, I’m left with the simplest truth of all: insurance is just another bet. A bet against your own luck, your own plans, and the whims of fate. It’s a dance with potential disaster where you hope to lead gracefully, but prepare to stumble. So, fellow truth-seekers, when you stand at the crossroads of coverage types and policy options, remember this: it’s not about picking the perfect plan, but about choosing which uncertainties you can live with. Because in the end, life above the clouds—or anywhere else—is nothing if not unpredictable.