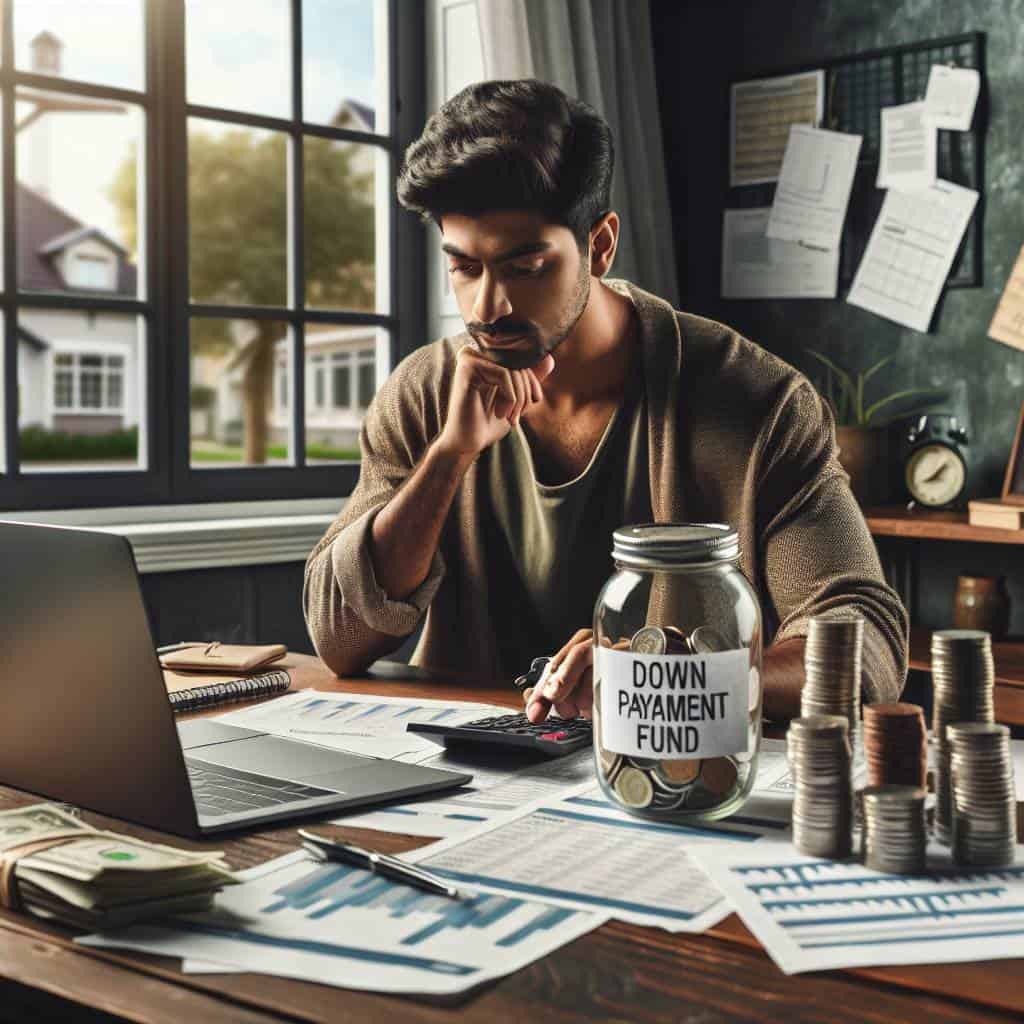

I’ve always said that saving for a down payment is the financial equivalent of trying to lose weight while working next to a bakery. The smell of freshly baked pastries, or in this case, spontaneous online sales, always tempts you to stray from your goal. I remember the first time I decided to stash some cash for a house. I was naive, thought it would be straightforward. But reality hit hard. Every time I made progress, some unexpected expense would swoop in like a seagull at a picnic, snatching away my hard-earned savings. It’s a relentless cycle that makes you question if owning a home is just an urban myth.

So here’s the deal. I’m not going to sugarcoat it. Saving for a house deposit is brutal, but it’s not impossible. In this article, we’ll cut through the nonsense and get to the heart of what it really takes to save for a down payment. From understanding the basics of mortgage mind games to crafting a savings plan that actually works, I’ll guide you through the storm. No fluff, just straight talk on how to navigate this financial labyrinth and maybe, just maybe, walk away with the keys to your new home.

Table of Contents

How My Coffee Addiction Sabotaged My House Deposit Dreams

I’ve always prided myself on my ability to juggle numbers with the kind of precision that makes a surgeon’s scalpel look blunt. But when it came to my coffee addiction, I was as blind to the truth as anyone can be. You see, it started with a harmless cup here and there—an innocent enough affair. Until one day, I glanced at my bank statement and realized I was bleeding money faster than my savings plan could mop it up. My once sky-high dreams of a house deposit were sinking under a sea of lattes and espresso shots.

Here’s the brutal truth: that daily habit of mine, the one that seemed so insignificant, was stealthily eroding my financial foundation. It’s easy to justify a five-dollar coffee when you’re bleary-eyed and desperate for a caffeine fix, but multiply that by thirty days and you’ve got yourself a monthly mortgage payment. I was sabotaging my own blueprint for a home with each swipe of my card, undermining the very basics of saving. The plan was simple enough—sock away a chunk of each paycheck to build up that elusive deposit. But in reality, my coffee expenses were the quicksand swallowing my dreams whole. So, if you find yourself in the same boat, I urge you to look closely at your habits. Sometimes, the little luxuries are the biggest culprits in derailing your financial future.

The Cold, Hard Truth About Deposits

Saving for a down payment is less about the dream and more about the relentless grind of turning pennies into bricks.

The Bottom Line: No More Fairytales

In the end, saving for a house deposit taught me more about patience and grit than any spreadsheet or financial seminar ever could. It’s not a glamorous journey, and anyone who tells you otherwise is selling you a fairy tale. It’s about looking the brutal reality in the eye and deciding to keep going, even when the numbers don’t add up nicely. You can’t sugarcoat the struggle of watching your savings account grow at a snail’s pace while housing prices sprint ahead. You just keep moving, one step at a time, knowing that every dollar saved is a small victory against a system that’s anything but forgiving.

There’s no magic formula or secret sauce to make it easier. It’s about discipline, sacrifice, and a little bit of stubbornness. I’ve learned to embrace the chaos and unpredictability, knowing that the ocean of financial uncertainty is not there to drown me, but to challenge me. Saving for a down payment isn’t about reaching a destination; it’s about surviving the journey with your sanity intact. And maybe, just maybe, when you finally hold those house keys in your hand, you’ll realize it wasn’t just about buying a home. It was about proving to yourself that you could weather the storm and come out stronger on the other side.