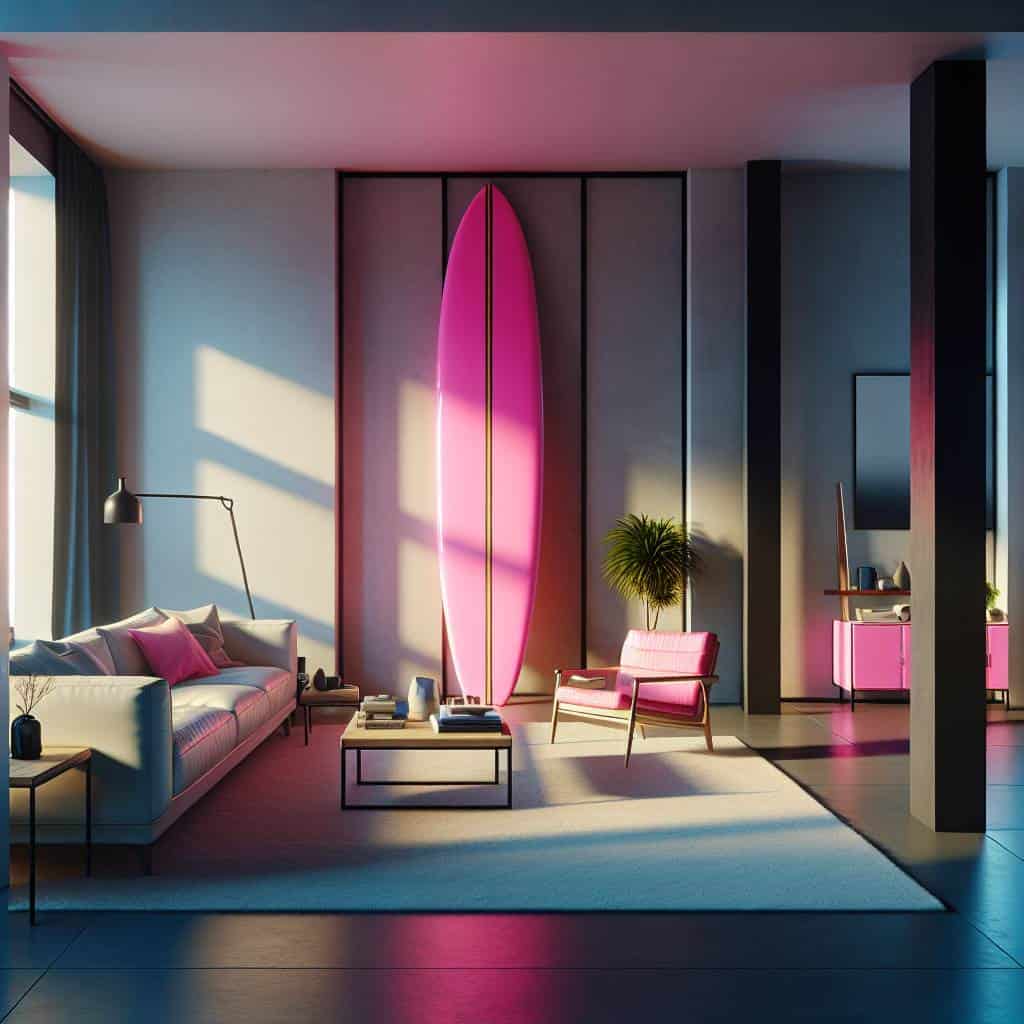

I once bought a neon pink surfboard because it promised me freedom. Never mind that I’ve only surfed twice in my life and live miles from the nearest decent wave. It sat in my living room like a neon sign flashing “Impulse Buyer”. That surfboard became a monument to my financial idiocy—a daily reminder that my wallet and I were not on speaking terms. Let’s be honest, we’ve all had those moments where our brains take a mini-vacation, leaving our bank accounts to fend for themselves at the mercy of shiny objects and wild whims.

So, what now? Well, I’m here to drag these money mistakes into the light, kicking and screaming. Together, we’ll dissect the chaos of impulse spending, lifestyle inflation, and that slippery slope toward debt. We’re going to unravel the mess I’ve made and, hopefully, help you avoid the same pitfalls. This isn’t about shaming the slip-ups but learning from them—transforming financial blunders into stepping stones on the path to monetary sanity. Buckle up, because we’re diving into the stormy seas of personal finance, and I promise, no jargon, no fluff, just the raw truth.

Table of Contents

Debt: The Unwanted Houseguest That Refuses to Leave

Debt. It’s like that one houseguest who shows up unannounced, plants themselves on your couch, and just won’t leave. No matter how many polite hints or direct requests you make, it lingers, eating up your resources and disturbing the peace. The trouble is, debt isn’t just inconvenient—it’s a creeping shadow that can darken your financial future. It all starts innocently enough with a little impulse buying—a new gadget here, a dinner out there. But soon, as lifestyle inflation sneaks its way into your daily habits, that unwanted guest has unpacked its bags and is raiding your fridge.

Now, let’s talk about how this all spirals out of control. Picture this: You’re living your life, trying to keep up with whoever or whatever Instagram convinces you is the benchmark of success. You swipe, swipe, swipe, until your credit card starts to feel like an extension of your hand. But here’s the truth bomb—every swipe is an invitation for debt to settle in a little deeper. It’s easy to ignore this when the world around you is whispering sweet temptations. But if you listen closely, you can hear the faint, nagging truth that debt isn’t just a number. It’s a weight, a constant reminder that you’ve overextended yourself. And the worst part? It’s damn hard to evict once it’s made itself at home.

So, how do you kick out this unwelcome guest? First, recognize the traps: impulse spending and lifestyle creep. These are the siren songs luring you into debt’s embrace. Next, arm yourself with a battle plan. Budgeting isn’t just about numbers; it’s about reclaiming control, setting boundaries that keep debt at bay. Remember, avoiding debt is a continuous effort, like keeping the sea from reclaiming the shore. It requires vigilance, honesty, and sometimes, a little tough love with yourself. But once you start living within your means, you’ll find that peace of mind is worth the price of resisting those fleeting temptations.

The Wallet’s Lament

Spending without thought is like sailing into a storm without a compass—thrilling until you’re drowning in debt.

The Ledger of Life: Final Thoughts

Reflecting on my financial journey feels like walking along that familiar windswept beach where I grew up, each step an echo of lessons learned the hard way. Impulse spending? It’s that rogue wave that catches you off guard, drenching you in regret. But like the tide, it teaches you to respect its power, to keep a wary eye on the horizon. I’ve come to realize that avoiding these common money pitfalls isn’t about denying yourself the joy of spending, but about understanding the rhythm of your own finances, much like mastering the unpredictable dance of the ocean.

Lifestyle inflation is the sneaky undertow that drags you further from the shore of financial stability. It whispers sweet temptations, coaxing you to live beyond your means. But here’s the truth: the real richness in life comes not from the things we accumulate, but from the experiences that enrich our souls. So, I’ve learned to anchor myself to what truly matters, to navigate this sea of life with a clear compass. Debt may have been an unwelcome guest, but it’s taught me resilience. To chart a course towards financial clarity, embracing each wave with a fearless heart.