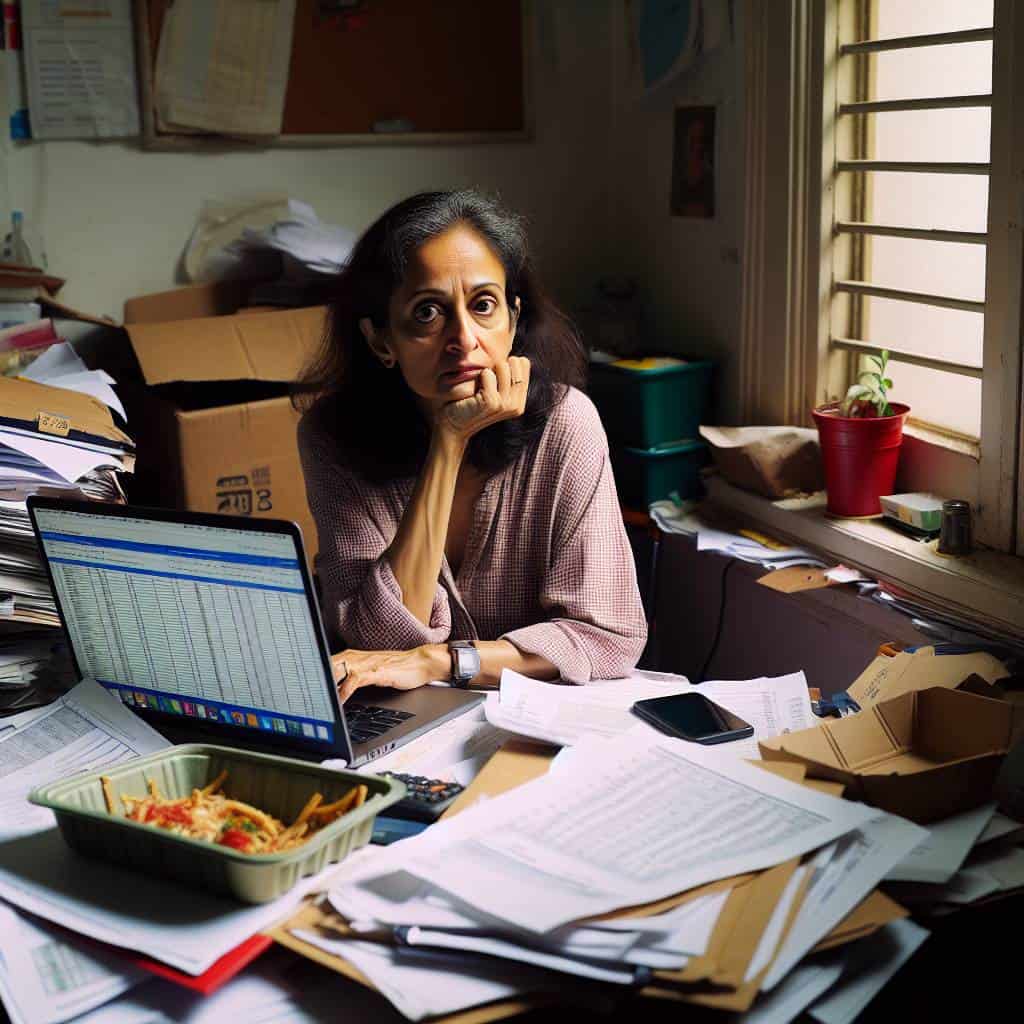

I remember sitting in my cramped apartment, surrounded by stacks of financial reports and empty takeout boxes, when it hit me: I had no clue how I was going to afford life beyond the age of 65. My retirement plan was more of a pipe dream than a plan—a fantasy concocted during a caffeine-fueled spreadsheet marathon. Sure, I could crunch numbers all day for someone else, but when it came to my own future, I was as clueless as a sailor without a compass. It was a sobering moment, realizing that my golden years might just dissolve into a haze of overdue bills and regret if I didn’t get my act together. So, I did what any self-respecting accountant would do—I dove headfirst into the labyrinthine world of retirement planning, determined to untangle the mess for myself and anyone else stuck in the same boat.

In this article, I’ll strip away the jargon and get straight to the heart of what you need to know about planning for retirement. We’ll cut through the nonsense surrounding savings, pensions, and financial plans, giving you the tools to start early and avoid the pitfalls of ignorance. Expect blunt truths and a few hard-earned lessons as we navigate the murky waters of ensuring a future that doesn’t involve choosing between heating your home and eating dinner. Because let’s face it, the only thing worse than being broke is being old and broke.

Table of Contents

Confessions of a Former ‘I’ll Start Saving Tomorrow’ Procrastinator

I used to be that person—the one who’d sigh, push aside any talk of retirement, and say, “I’ll start saving tomorrow.” Tomorrow. The most seductive illusion of time. But here’s the unvarnished truth: tomorrow never came. I was stuck in an endless loop of procrastination, watching opportunities slip away as if they were grains of sand slipping through my fingers. My bank account was as barren as a desert, while I convinced myself that my paycheck would somehow stretch into a comfortable retirement. Spoiler alert: it won’t. You think a bit of extra cash from skipping your morning coffee will do the trick? Think again. The secret isn’t in the pennies you save; it’s in the mindset you cultivate.

It took a cold, hard look at my future to break free from this delusion. Numbers don’t lie, and they were screaming that my ‘someday’ needed to be ‘today’. The concept of saving isn’t just about squirreling away a few dollars when you can. It’s about setting up a structured plan—being strategic and disciplined. Pensions, 401(k)s, IRAs—these aren’t just alphabet soup to ignore. They’re your lifelines. So, I ripped off the blindfold. I started small, but I started. I crafted a plan, not because I’m some financial savant, but because I refused to let my future self curse my present inaction. And let me tell you, there’s nothing quite like the relief of watching those savings grow, knowing that each decision you make today is a step towards a future where you’re not scraping by. Planning for retirement isn’t glamorous, but neither is being broke at 70.

The Wake-Up Call You Can’t Snooze

If you think your pension plan is a safety net, you’re walking a tightrope without a harness. Start saving early, or risk retiring into a mirage.

The Tide of Tomorrow

I never thought I’d be the one talking about retirement with any sense of authority. Yet here I am, the accountant who once scoffed at the idea of planning for a future that felt a million years away. The truth is, waiting to start saving was like standing on the edge of a crumbling cliff, pretending the ground beneath my feet wasn’t giving way. I learned the hard way that the promise of a pension or the elusive ‘someday’ plans weren’t enough. The sea taught me well: it’s not about when you start, but that you do. Every dollar saved is a grain of sand in the hourglass, a step away from that rusty fantasy of old age.

Now, I find myself urging anyone who’ll listen—start now, start early. Because when the waves of life crash at your feet, they’ll either reveal treasures of foresight or the wreckage of procrastination. It’s a journey, not a destination. I’ve walked that road of excuses, and I know the terrain better than I’d like to admit. But each step forward is a commitment to a future where the sunset is more than just an end—it’s a promise kept. Numbers don’t lie, and neither do the lessons of time. So, grab that truth with both hands and let it guide you. The tide waits for no one.